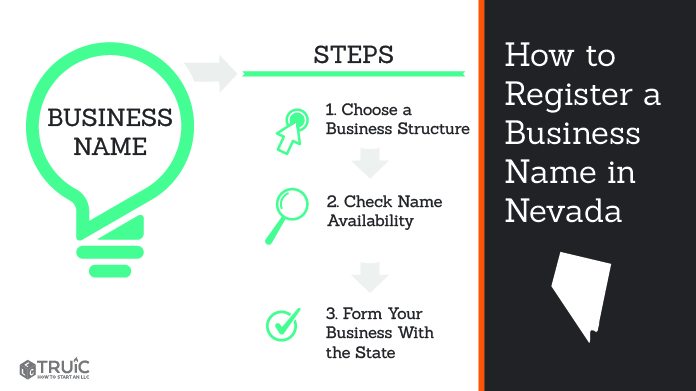

How to Register a Business Name in Nevada

Toregister a business name in Nevada, you’ll need to register your business with the state. You can form an LLC or corporation, or file for a “doing business as” name with your state’s business division.

OurHow to Register a Business Name in Nevadaguide will walk you through each step of the process in Nevada. Check out our otherHow to Register a Business Nameguides to learn about registering a business name in every state.

Or simply use a reliable professional service:

Northwest($29 + state fees).

(We recommenddoing aname checkfirst)

Step 1: Choose Business Structure

The type of business structure you choose to form will determine how you register the business with the state. Use ourhow to choose a business structureguide to help choose which business structure is best for you, whether it’ssole proprietorships,general partnerships,118bet金博宝 , andcorporations.

The factors you should consider when choosing a business structure will depend on your needs and wants for personal liability protection, tax liabilities, and paperwork to keep the company in compliance.

Recommended:We typically recommendforming an LLCfor most entrepreneurs because this structure comes with personal asset protection, has no double taxation, and is pretty easy to maintain.

If you would like to use a service, read our guide on the118金宝app .

Sole Proprietorships and General Partnerships

By default, sole proprietorships operate as the same name as the owner while general partnerships must include the surnames of all the partners.

To use a different name to conduct business, the business owner(s) must申请一个内华达州虚构的公司名称— also commonly referred to as a doing business as (DBA) name.

LLCs and Corporations

Both LLCs and corporations require unique names in Nevada that must follow certain naming requirements:

Recommended:LearnHow to Start an LLC in Nevadaor, if you need a more rigorous operating structure, learnHow to Start a Corporation in Nevada.

Step 2: Check Name Availability

When registering a business name, it's important to make sure it's unique and no one else in your state formed a company with it or has control of it online as a domain name.

Domain Name Search

We strongly recommend that you also check to see if your business name is available as a web domain (URL). Even if you don't plan to create a business website today, you may want to buy the web address to prevent others from acquiring that domain name. If the web domain is available then it’s likely the name will also be available in a business search.

Nevada Business Name Search

Next, search theNevada Business Searchtool. This is an important step in the process because your filing will be denied if you try to file for a name already in use.

Search requirements can vary depending on your business needs. For example, a unique and available name is required to:

- File for formal business structures like LLCs and corporations.

- File a DBA name for any business structure.

A state-level name search isn’t required for informal business structures like sole proprietorships or general partnerships in Nevada.But, if you decide to register a fictitious firm name or DBA name, you’ll need to search the database to see if your desired name is unique and available.

Step 3: Form Your Business With the State of Nevada

Once you have selected your business structure and name, you will need to file your formation documents with the state, which will register your business with the State of Nevada.

To register your Nevada LLC, you'll need to file the Articles of Organization with the Nevada Secretary of State. You can apply online or by mail. Read ourForm an LLC in Nevadaguide for details.

或者使用公关ofessional service likeNorthwestorLegalZoomto form your LLC for you.

To register your Nevada corporation, you’ll need to file the Articles of Incorporation with the Nevada Secretary of State. Read ourForm a Nevada Corporationguide to learn more.

Additional Considerations

Once you confirm the availability of your business name and secure it, you can choose to apply for a trademark for your business. This typically costs around $225 to $400 plus any attorney fees as well as a renewal fee every 10 years.

While this cost can be high for a start-up or fledgling business, it will give your company brand nationwide protection backed by federal law. That means if others try to do business with the same — or a similar — name as yours, you’ll have legal precedent on your side. For most small businesses, this really isn't necessary unless they are thinking of going national.

Recommended:LearnHow to Trademark Your Business Nameusing our free guide.

How to Change the Name of a Nevada Business

Changing the name of a business in Nevada can be done in two ways: by申请一个虚构的公司名称or by submitting anamendment to the legal name of an existing business.

The first method,申请一个虚构的公司名称(also known as a DBA name), is the easiest way to operate your business using a different name without needing to change its legal name.

A DBA name is the only way forsole proprietorships and general partnershipsto have a different business name. It’s also the easiest method forLLCsandcorporationsto follow because it allows them to avoid filing an amendment or complicating their business operations while enabling them to operate with brand names that don’t include the necessary LLC or Inc. suffix required in a legal name.

If you want to change the legal name of your LLC or corporation, however, filing an amendment to the legal name of an existing business is your best option. Here are links to forms for both options:

Both can be mailed to the Nevada Secretary of State or submittedonlinealong with the $175 filing fee.

Frequently Asked Questions

Is a business license required in Nevada?

Yes, you must obtain a state business license in Nevada throughNevada’s SilverFlume Business Portal. In addition, your business may require licensing from your city and/or county.

How much does a business license cost in Nevada?

The annual fee for a state business license in Nevada is $500 for corporations and $200 for all other business types.

How do I get a tax ID in Nevada?

You can obtain your Nevada state tax ID by registering your business with the Department of Taxation onNevada’s SilverFlume Business Portal.

How much does it cost to start an LLC in Nevada?

Forming an LLC in Nevada costs $75 to file the Articles of Organization with the Nevada Secretary of State plus $200 for a state business license and $150 for the initial list fee.